Championing Responsible Debt Solutions for a Better Tomorrow

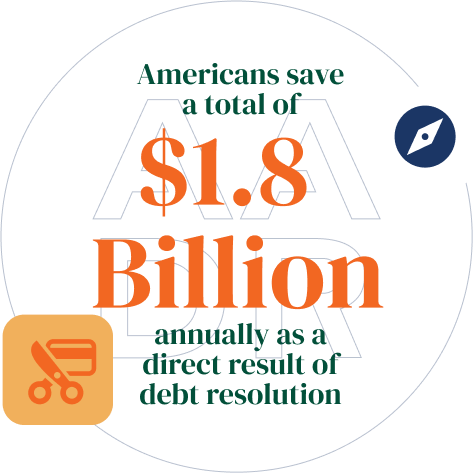

AADR’s mission is to educate consumers and policymakers about debt resolution and its benefits, hold debt resolution companies to the highest industry standards, and protect and expand access to accredited debt resolution services nationwide.

Latest News

News & Press Releases | Aug 1, 2023

American Fair Credit Council Relaunches as the American Association for Debt Resolution

More

2024 —

AADR 2024 Annual Conference

Four Seasons Hotel Las Vegas